Perspectives

Five common career paths in corporate accounting

Whether you’re just starting out, stepping into leadership, or aiming for the C-suite, careers in accounting and corporate finance offer pathways for advancement and ongoing growth across organizations in every industry. Corporate accounting is more than just working with numbers at a desk. It is a critical discipline that monitors fiscal health, influences key business decisions, helps company leaders develop strategy and supports the management of the entire organization.

If you have just finished school or are new to the profession, knowing the options for career growth in corporate accounting will help you make smart decisions and plan a future you will enjoy. If you’re further along in your career, this information can help you figure out your next step or build a long-range plan with an ultimate end goal.

We’ll overview five common career paths in corporate accounting: financial accounting, corporate finance, internal audit to risk and compliance, cost accounting and manufacturing finance, and accounting to business unit leadership. For each path, we’ll outline career progression, common industries, helpful skills and certifications, and typical salary ranges.

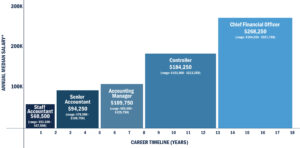

1. Financial accounting pathway

The financial accounting team plays a critical role in managing a company’s overall health and growth. They prepare, track and analyze financial statements and cash flow while providing insights to inform strategic decisions.

Perfect for you if: You enjoy structured processes, attention to detail and want a clear ladder to climb.

Industries: All industries, especially large corporations, financial services, healthcare, nonprofits

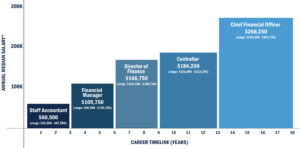

Source: Robert Half 2025 Salary Guide

Career progression:

- Staff accountant (1–3 years): The most common entry point into corporate accounting. You’ll handle journal entries and reconciliations and assist with month-end close.

- Senior accountant (2–4 years): You’ll take on more responsibility, often reviewing others’ work and diving deeper into financial analysis and reporting.

- Accounting manager (2–5 years): You’ll start managing a team and overseeing accounting operations.

- Controller/assistant controller (3–7 years): The lead responsible for the entire accounting function of a company or business unit, you’ll collaborate closely leadership on financial decision-making.

- Chief financial officer (CFO): The top financial role, you’ll be responsible for overall financial strategy and leadership.

Certifications to consider: CPA licensure is common and highly valued.

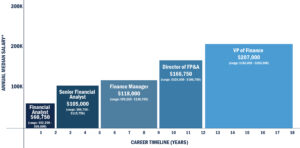

2. Corporate finance pathway

The corporate finance team helps company top leaders make mission-critical financial decisions: investment, capital, long-term financial goals and planning. They focus on using data to drive growth, assess risk and help shape the direction of a business’s future.

Perfect for you if: You’re interested in forecasting or financial modeling, want to influence business strategy and enjoy fast-paced environments.

Industries: Tech, consumer goods, retail, pharma

Source: Robert Half 2025 Salary Guide

Career progression:

- Financial analyst (1–3 years): You’ll work with budgets, forecasts and performance reports.

- Senior financial analyst (2–4 years): You’ll begin owning full financial models and business segments.

- Finance manager (3–5 years): You’ll manage analysts and help drive decision-making with data.

- Director of Financial Planning & Analysis (2–4 years): You’ll lead planning cycles and coordinate with executives.

- VP of finance/CFO: You’ll own financial management and strategy and lead company-wide planning.

Certifications to consider: A CFA can boost your trajectory; a CPA is less common but valuable

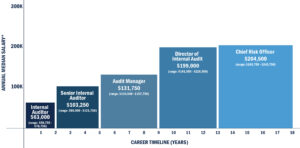

3. Internal audit to risk and compliance

Internal auditors and risk and compliance teams help businesses operate responsibly. They review systems, processes and controls to ensure compliance with legal and ethical standards, reducing risk, preventing costly mistakes and protecting the company’s reputation.

Perfect for you if: You are detail-oriented, love structure and want to help organizations stay safe and compliant.

Industries: Banking, insurance, healthcare, government, contractors

Source: Robert Half 2025 Salary Guide

Career progression:

- Internal auditor/audit associate (1–3 years): You’ll review internal processes and controls.

- Senior internal auditor (2–4 years): You’ll handle more complex audits and provide risk insights.

- Audit manager/internal controls manager (3–5 years): You’ll lead audit teams and work cross-functionally.

- Director of internal audit / compliance (3–5 years): You will set audit strategies and policies.

- Chief Audit Executive/Chief Risk Officer (CRO): You’ll oversee company-wide risk and compliance efforts.

Certifications to consider: CPA, Certified Internal Auditor (CIA) or CISA (for systems audits)

I’m interested!

Complete the fields below. Fields marked with “*” are required.

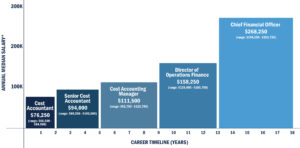

4. Cost accounting and manufacturing finance

Cost accounting and manufacturing finance teams sit at the intersection of operations and strategy. They manage, monitor and analyze costs and performance while providing strategic insights to improve efficiency and support smarter decision-making.

Perfect for you if: You enjoy digging into operations, understanding how things are made and improving efficiency.

Industries: Manufacturing, automotive, aerospace, logistics

Source: Robert Half 2025 Salary Guide

Career Progression:

- Cost accountant (1–3 years): Track inventory, analyze cost variances, support production finance.

- Senior cost accountant/plant accountant (2–4 years): You will work closely with plant managers and operations teams.

- Cost accounting manager/plant controller (3–5 years): You’ll manage costing systems and guide financial decisions on the ground.

- Director of operations finance/plant finance director (3–5 years): You’ll bridge finance with operational strategy.

- CFO/Division CFO: Lead financial decisions at the enterprise or division level.

Certifications to consider: A CMA or CPA is helpful, but industry knowledge is just as critical.

5. Accounting to business unit leadership

The business leadership team guides a company’s strategy, growth and financial health. They lead the organization by translating financial insights into big-picture decisions that drive long-term success.

Perfect for you if: You want to use your financial background as a stepping stone into broader leadership roles.

Industries: Tech, healthcare, energy, retail and anywhere with large operating divisions

Source: Robert Half 2025 Salary Guide

Career progression:

- Staff/senior accountant: (2–4 years): You’ll start by mastering the fundamentals.

- Finance analyst/finance manager (2–5 years): You’ll apply your skills to budgeting and business analysis.

- Director of finance or operations (3–5 years): You will lead cross-functional teams and help shape strategic goals.

- Finance business partner/controller (3–6 years): You’ll collaborate closely with leadership on financial decision-making.

- General manager/Chief Operating Officer (COO) /CFO: You will step into broad leadership, managing people, processes and profits.

Certifications to consider: A master’s degree is instrumental and leadership experience is key.

There’s no such thing as only one path to accomplish your goals.

What we’ve outlined above are examples of common pathways to reach certain outcomes. However, there’s no single, perfect path to success in corporate accounting, and that’s one of the most exciting things about the field. You might start in financial reporting and discover a passion for operations. Or, begin in audit and transition into strategy. Many professionals pivot between roles, industries and even career tracks as their interests evolve.

The key is to stay curious, build transferable skills and pursue opportunities aligned with your goals. Everyone’s journey looks a little different and that’s completely normal.