Perspectives

Current events explained and a primer on energy security canons

By

Casual observers can be excused for not comprehending topsy-turvey events in energy. As September turned to October 2022, the gap between European and U.S. natural gas prices stood at 10X – $60 million British Thermal Units (MBTUs) vs. $6 MBTUs. True, Russia has drastically cut gas supplies into Europe. That still doesn’t explain the unprecedented premium being paid by Europe’s customers. Meanwhile, crude oil prices, which retreated from $100/barrel in August, are back above $90/B on the news that OPEC+ has cut production by 2 million barrels per day (MB/D). The EU is adopting price caps on Russian oil purchases. Putin, for his part, threatens to remove even more supplies from the market.

What is going on here? What accounts for natural gas prices that threaten to bankrupt European manufacturers and utilities? Why did crude prices decline in the first place and why has OPEC surprised the markets with a larger than expected cut? Are price caps any kind of answer? We will try to answer these questions, touching briefly on the “known knowns” and spending more time on lesser known but more explanatory factors.

We start with some data. Russia has deliberately removed a large amount of natural gas from the European market. In 2021 it supplied about 150 billion cubic meters (BCM) of gas or about 12.5 BCM per month. That figure is now down to between 1-2 BCM. As for crude oil, EU countries have partially stopped buying Russian oil and plan a more focused embargo by year end. The EU + Great Britain bought 2.6 MB/D of Russian crude in 2021 plus another 1+ MB/D of refined products. Those figures are now down to about 1 MB/D of combined crude oil and product, most of it crude. Russia has been forced to sell the difference to distant markets like India and China, absorbing substantial logistics and marketing discounts. Perhaps 1 MB/D of pre-war Russian oil supplies are no longer being sold.

Next, we add some context. The oil market was tight before the Ukraine conflict broke out. Global investment in oil exploration and production fell sharply after 2014. Some of this was in response to prices, which declined from $90+/B to around $50/B. Some of it reflected Wall Street firms’ disillusionment with the performance of America’s fracking companies. These firms funded a dramatic expansion in U.S. production by tapping copious amounts of private equity. Much of that capital was destroyed when production surged, bringing about collapsing prices. PE investors then switched to demanding investment returns and capital distributions; these demands were reinforced by pressures to apply ESG criteria to capital allocation, i.e., to stop funding fossil fuel investments. Collectively all these pressures brought about sustained underinvestment in new oil/gas exploration and production. Capital budgets and firms like Chevron and Shell fell by 50% or more. When Covid hit, driving crude prices below $30/B, exploration/production budgets went to rock bottom levels.

As for European natural gas, it now is widely appreciated that allowing Russia to supply 40% of the continent’s consumption was a policy mistake. Unlike oil, natural gas is not easily replaced logistically when a major source dries up. Liquified Natural Gas (LNG) is the flexible source of supply, but that requires available export supplies, specialized ships, regasification facilities and pipelines connecting importing sites to consumers. Europe, in general, and Germany, in particular, lack this infrastructure.

So much for known problems and essential context; let’s now turn to fundamentals of Energy Security, starting with the global oil market. Since 1961, this market has been characterized by a seller’s cartel – known as the Organization of Petroleum Exporting Countries (OPEC). Such cartels exist for one purpose – to raise the average price realized for their product by managing the supply offered.

Initially OPEC’s strategy was defensive; it aimed to avoid price declines by preventing individual members from trying to maximize revenues by offering more volume for sale. However, in 1973 OPEC discovered another possibility; the global oil market had tightened, spare capacity in the U.S. being exhausted. OPEC found that removing a small amount of oil from a tight market could produce an outsized price gain. In October of that year an Arab-Israel War broke out. OPEC then ‘embargoed’ the U.S. and the Netherlands for their support of Israel. This relatively small volume restriction drove prices up over 400%. A similar disruption in 1979, when Iraq invaded Iran, produced a similar price spike.

These events yielded the first energy security ‘canon,’ this for global oil – when spare capacity ceases to exist outside of OPEC, that organization gains outsized pricing power; by restricting supply OPEC then gains more on price than it loses on volume. Over time a more nuanced rule became clear – the spare capacity needed to prevent OPEC from having this pricing power could reside outside of OPEC, within OPEC at countries who would “cheat” on their quotas, or some combination of the two.

It is in the light of this “canon’”that the recent energy policies of the U.S. and the EU now look mistaken. In their zeal to convince voting populaces of the need to transition from fossil fuels, they ignored the canon – that failing to maintain spare capacity in the global market would give the Sellers Cartel, and specifically its two biggest players, Russia and Saudi Arabia, outsized leverage. OPEC+’s 2 MB/D October surprise convincingly signaled that this leverage would be used to keep oil prices (and consumer inflation) high even as recessions loom.

As for the temporary decline in oil prices over the summer, this was largely the product of the U.S. releasing ~1 MB/D of oil from its Strategic Petroleum Reserve (SPR). These releases combined with rising expectations of global economic slowdown caused traders to sell oil futures, lowering prices. In part the Saudi-led OPEC cuts are intended to counter these moves. The cuts likely will be effective. It is true that OPEC was not fully producing its quotas and some of the announced 2 MB/D cut is thus just recognizing what exists. However, U.S. SPR sales will soon cease, the Biden Administration faces the need to refill the Reserve, and OPEC is experienced in gauging recession-induced demand destruction.

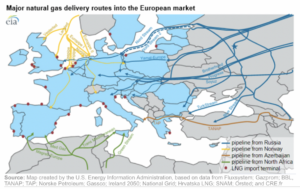

As noted, natural gas has a different global market structure. Regions with abundant natural gas, like the U.S., Canada and Mexico, service integrated markets with logistically efficient pipelines. Regions which must import, like Europe, also try to use pipelines from exporting nations to full their supply gaps. This is the reason why so many pipelines, from Algeria, Azerbaijan, Kazakhstan and of course Russia, have their terminus in EU nations (see map below). These pipeline networks define a regional gas market. Marginal supplies are then served by liquified natural gas (LNG). This gas is typically more expensive due to shipping costs being higher than pipelines and the export source being more distant. Under normal circumstances, the landed cost of LNG puts a ‘cap’ on prices, and when pipeline supplies exceed demand, pipeline suppliers will discount prices to place their commodities. It was in this way that ‘cheap’ Russian natural gas gained such a large share of the EU market. Gazprom, the Russian gas monopoly, backed its growing pipeline network with cheap supplies, thereby discouraging competitors from building competing infrastructure. This strategy was “successful.” Lulled by cheap gas and Russia’s fervent “reliable supplier” claims, Germany phased out its nuclear plants failed to connect its market to other EU countries with gas import capacity, banned fracking and built no LNG capacity of its own.

Germany’s sad example and current plight point to the second energy security ‘canon’ – LNG import capacity is a “necessary infrastructure reserve” to discourage unreliable gas suppliers from exploiting any immediate market leverage they may gain. Note its absence in Germany in the map above.

The mere existence of such import capacity is not, by itself, an adequate security guarantee. There must be LNG export capacity somewhere in the world with gas behind it to respond to a supply crisis. It is very helpful if the gas behind such export capacity is surplus supply looking for an outlet. When such is the case, gas purchased by the LNG export plant will be cheap and the landed cost of LNG for the importer will be affordable. When the gas ‘behind the export plants’ is in short supply, importers will engage in bidding wars. This type of market action is happening right now. Europe’s eagerness to fill its gas storage ahead of winter has led it to outbid other countries for available LNG. This is a major reason why the cost of gas is so high in Europe – they have filled gas storage to 89% of capacity by outbidding Asia and South America for scarce LNG supplies.

Europe’s race to counteract Russian supply curtailments and subsequent price spikes brings up the matter of price cap plans. The EU and the U.S. are in the latter stage of imposing a price cap on Russian crude oil exports. The countries already plan to embargo Russian crude by banning Russia’s exports from accessing their maritime insurance and shipping. The price cap plan, touted to go into effect on Dec. 5, grants an exemption to these prohibitions so long as the price for the Russian crude falls below a stated cap. In effect, the EU aims both to impede Russia’s global sales and then logistically channel its crude into Europe at a discounted price. This type of oil consumer collective action has never been tried. Will it work? Why only try it for oil and not natural gas?

Europe’s plans to set ceiling prices on imported Russian oil are best understood as the formation of a Buyer’s Cartel. By agreeing to price caps, EU nations promise not to compete for supplies by bidding higher prices. In theory this should force Russia to choose between selling outside Europe and absorbing both price discounts and heightened logistical costs or selling to Europe at the cap price. In theory, these prices should converge, setting the cap price and Russia’s market alternatives in equilibrium. As a happy bi-product, the avoidance of competitive bidding should constrain marginal prices from spiking on small volume deals and carrying base-load supply prices higher as well.

Will such a cap plan work in practice? That depends on Russia’s reading of the market and its subsequent tactics. If the oil market remains supply constrained, Russia could curtail remaining supplies into Europe and test the Buyers Cartel’s unity. Cutting off pipeline oil supplies into Hungary would be an obvious pressure point. This and similar supply curtailments would again send Europe off to scour foreign markets for replacements. Foreign prices would go higher, potentially forcing upward cap adjustments. Meanwhile, incentives would intensify within Europe for individual nations to ‘cheat’ on their cap commitments. In short, the cap price plan only seems feasible if there are ready replacement supplies for further Russian cutbacks or if Russia fails to test the Buyer’s Cartel unity.

Thus, the third energy security canon stipulates that for a Buyer’s Cartel to be effective, there must be ready supplies available to replace further supply curtailments by the Cartel’s target. Demand reductions can help here by in effect converting existing supplies into spare capacity. However, demand destruction usually is accompanied by immediate economic costs and often is not sustainable when economic growth resumes.

Why are cap prices not planned for natural gas? The short answer is that the EU may try to develop a plan soon.However, there are few ready gas supplies to replace further Russian supply cuts. Given this and the strategic nature of gas for European power and industry, the EU ultimately may not be willing to risk Russia removing even more supplies from the market.

How then can adequate replacement supplies of oil, and especially of natural gas, be made ready? The best answer brings up the f-word, fracking. Invigorating fracking both in and outside of the U.S. is the best short- and medium-term solution to the current crisis. It also offers the most flexible “bridge” to the Energy Transition. Let’s see why this is so.

Fracking for oil and gas is in industry-parlance “short cycle.” This means available acreage can be rendered productive in a matter of months, not years. Typically, this involves mobilizing drilling rigs, fracking crews and supplies – a much simpler process than either offshore or Arctic activity. These latter efforts involve years of exploration followed in success cases by complex production engineering, facilities construction, and compliance with a plethora of regulatory restrictions. Such “long cycle responses” were part of the reason that it took years for oil and gas supplies to respond to earlier OPEC price actions. Fracking generally involves little exploration risk and can get wells producing in three to six months.

A second, less understood feature is that fracking is very good for producing natural gas. This is especially true where advanced hydraulic fracturing technique is conducted in extended-reach horizontal wells. This approach, developed in natural gas plays like the Barnett, Haynesville and Eagle Ford shales, has been hugely productive in the Pennsylvania and West Virginia Marcellus formations. There is another, less appreciated factor; when fracking is used to produce crude oil, it often produces large volumes of associated gas. This was responsible for the 2015-20 natural gas surplus in the U.S. when crude oil fracking produced large associated gas volumes out of the Texas’ Permian basin. U.S. natural gas prices fell to ~$2 MBTU as a result and stayed there – ‘lower for longer’ was the price complaint heard around the frack fields.

A third aspect of fracking is that it is relatively easy to halt. Without new drilling and stimulation, fracking wells and fields deplete rapidly. A halt in new drilling can lead to a noticeable decline in field production within months. Moreover, there are fewer stranded assets when fracking activity is halted. ‘Drilled but uncompleted wells’ (DUCs) may be left uncompleted until needed while associated gathering/separation and pipeline capacity will gradually be underutilized. The capital stranded will be much less than for offshore/Arctic. Should the Energy Transition proceed more rapidly than expected, fracking activities will be the least painful hydrocarbon production to dial back.

This points to the fourth Energy Security canon – to restore spare capacity to global oil and gas markets, hydraulic fracking must be incentivized and facilitated in prospective basins lying outside of OPEC+. The U.S. is one obvious candidate for such actions. Projections by the Energy Information Agency (EIA) and others suggest U.S. crude production could rise from todays ~12 MBD to 15 MBD within 2-3 years. Gas production could increase in line or even higher. There are numerous other prospective locations, notably Germany but also Canada, Mexico, Colombia, Argentina and Algeria. A full-fledged U.S. production effort would help propel similar activities elsewhere.

It has been noted that high prices have not resulted in an all-out recovery in U.S. fracking. Total U.S. production of 13 MB/D in 2019 has yet to be duplicated. Much of the tempered recovery pace is a response to the PE/ESG resistance discussed earlier. A good deal however is the result of the Biden Administration signaling clear intent to oppose new hydrocarbon production via hostile regulation. Its immediate cancellation of the Keystone XL pipeline was a major such signal. Largely eliminating new leases of federal lands is a second and its appointment of FERC regulators hostile to new inter-state pipelines is another. Adding vague climate risk criteria to permitting reviews hands opponents of new hydrocarbon production another regulatory basis for obstructing new projects. Talk of windfall profits taxes, which actually are being adopted in Europe, is a strong deterrent to aggressive fracking activity. Given these repeated messages and actions, it is difficult to blame the industry for assuming the Biden Administration will turn on it as soon as the immediate supply crisis has eased.

The Administration’s mixed signals, pleading for more production abroad while continuing to oppose it domestically, can be understood as a political dilemma. How can the Administration address its short-term supply shock issues without abandoning its longer-term commitment to transition away from fossil fuels? It senses that “false steps” here could signal to core constituencies that it is abandoning the climate fight and handing energy policy over to hard core opponents.

This need not be the case. There exists a policy mix which would reconcile short/medium term energy security needs with longer term climate strategy. Adopting these policies would require some political art – the art of negotiating a Grand Bargain on energy. However, the policy mix would have solid fundamentals and give major stakeholders on all sides of the issues some of their long-held aspirations.

This Grand Energy Bargain will be the topic of the next Director’s Blog.