News & Stories

Senior housing is a smart investment

Now is the ideal time to start investing in senior housing. Demographic trends show that we are only at the beginning of the “silver tsunami,” and the real estate industry is already seeing increases in demand for senior housing facilities.

By 2030, 81 percent of the U.S. population will be over age 65. However, the baby boomer generation has just begun to enter this period of their lives and will not turn 80 until 2026. Furthermore, Americans have longer life expectancies. As of 2015, there were 9.6 million Americans over the age of 82.

While some investors have started to capitalize on this demographic opportunity, there is still plenty of runway left. Only 15 percent of senior housing is owned by REITs, and other investors are just starting to enter this space. At the same time, those who have entered the space have seen strong returns, with three of the top 10 largest REITs investing in senior housing. These astonishing facts indicate that senior housing will be a strong, exciting asset class over the next few decades.

Key players and perspectives in senior housing

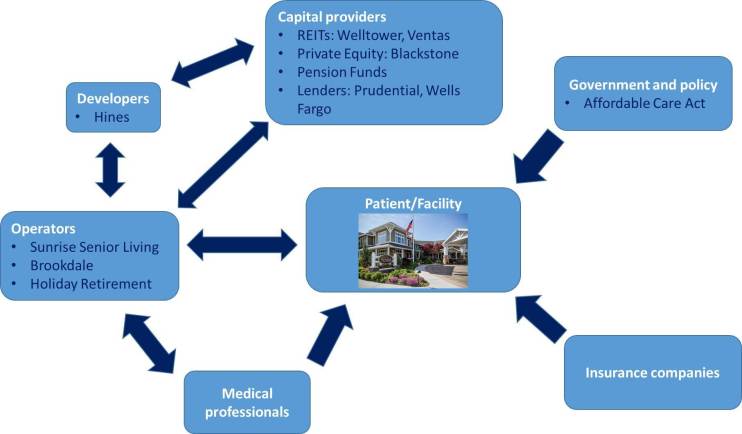

Senior housing is a complex industry that is just starting to become more transparent to investors and developers. The space requires some expertise and an understanding of the relationships and dynamics involved. All of the key players in the senior housing market are connected in some way – thus, a change by one player impacts others in this space.

The industry is focused on creating the best facility for consumers (or patients). A senior living facility is run by an operator, who hires the medical and administrative staff and runs the building on a daily basis. The patient pays for the facility through multiple means – usually including Medicare (government-funded), some insurance and, oftentimes, out-of-pocket funds. The operator sometimes serves as the developer of the property – however, sometimes a separate developer steps in to develop the building. All of this is funded by various external capital sources. Capital providers include REITs, private equity shops, pension funds and lenders.

The senior housing market is constantly changing due to the influence of and reliance on these different players – particularly the changing healthcare environment, which is moving to a more cost-efficient, outpatient, preventative model compared to the previous reactive, cost-inefficient hospital model. Firms’ success will be determined by how they adapt their investment strategies to this changing environment. Success will also come from strong partnerships, which can yield best-in-class operators and strong management of these facilities. Choosing the right partner and building – or acquiring the right facility – will make a difference in returns for capital providers.

Investment model and considerations

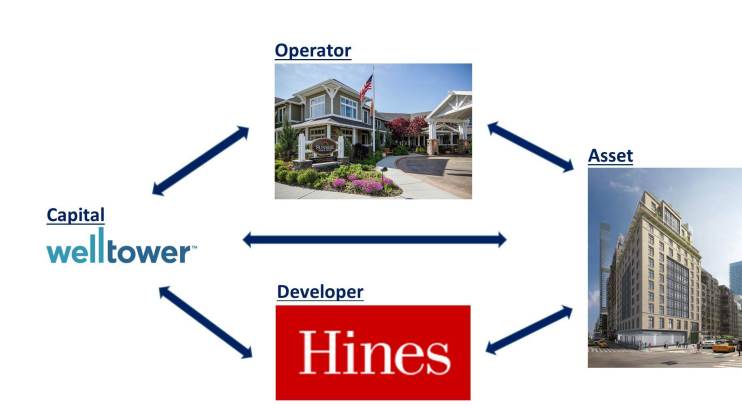

A capital provider like Welltower – the third largest REIT in the U.S. – will finance the construction of a new senior housing building, like this one in Midtown Manhattan. They will partner with an operator like Sunrise Senior Living, who will operate the building by hiring staff, providing medical care and organizing daily activities for residents. Selecting a good operator is critical to the success of a building.

The operator and investor will work with a developer – in this case, Hines – to design the best building for efficient, successful senior care operations. The developer will often exit the deal at stabilization, while the investor and operator hold onto the property. The operator pays rent to the investor each month. However, the RIDEA legislation allows REITs to access operational cash flows as well. In this model, an optimal coverage ratio is used to allow the REIT to receive as much rent as possible (as it is not taxed) and split the residual cash flow with the operator.

Future senior housing trends

Outpatient model

As healthcare costs have been rising, public health policy makers have focused on creating a more cost-efficient model of delivering care to the aging population. Instead of a reactive health care system, there has been a focus on a preventative system. In this system, most care is delivered in outpatient facilities at lower costs, instead of at the hospital.

Aging in place

Older Americans do not want to move out of their homes. The biggest competitor of senior housing facilities is the resident’s current home. If a resident decides to move or downsize, they typically want to move once – hence why the “aging in place” model has taken off, with independent living, assisted living and memory care facilities all located on the same campus. A facility’s proximity to – and partnership with – a nearby hospital is important to the continuum of care communities, as is proximity to medical offices.

Supply and demand

As the silver tsunami approaches the U.S., demand for senior housing is sure to grow. However, the supply of senior housing has already increased dramatically in some markets, making oversupply a consideration for developers. Some over-saturated markets have implemented moratoriums on senior housing, limiting development of new facilities. Though some analysts have exaggerated the oversupply of senior housing, there is still room to develop in most markets across the U.S.

Minimum wage and workforce shortage

Best-in-class operators are highly sought after, resulting in a clear shortage of top companies and staff – including administrators, registered nurses and certified nursing assistants – among senior housing facilities and other healthcare providers. There is a growing shortage of highly-qualified healthcare professionals in the U.S., putting pressure on companies to offer higher wages to land top talent. Minimum wage laws that are going into effect in California and other areas of the U.S. will also result in increased staffing expenses for healthcare companies.

The changing senior citizen

Sociologists have studied the baby boomer generation intensely, as their preferences for living out their golden years differ from previous generations. Boomers do not want to retire. Instead, they want to remain engaged with their community and live their lives with purpose. They do not want to feel isolated from society – they want to be extremely connected to people of all ages. Investors must understand how consumers’ preferences are changing in order to compete in this space.

A broader investor base

As more investors become knowledgeable about the senior housing space, they are increasingly putting their capital into these properties. The result is a large flow of capital being invested into the space, pushing up prices and compressing cap rates.

International potential

The U.S. is not the only country with an aging population. Japan’s population is aging ahead of the U.S., and the silver tsunami is affecting European countries as well. Investors should watch and learn from how these countries manages the aging crisis. While investors are just beginning to explore senior housing as an asset class in the U.S., there is potential for it to move into other markets.

By Laura Bartos (MBA ’17)

*Data courtesy of the National Investment Center for Seniors Housing and the 2016 NIC Fall Conference in D.C.