News & Stories

Learning about money matters

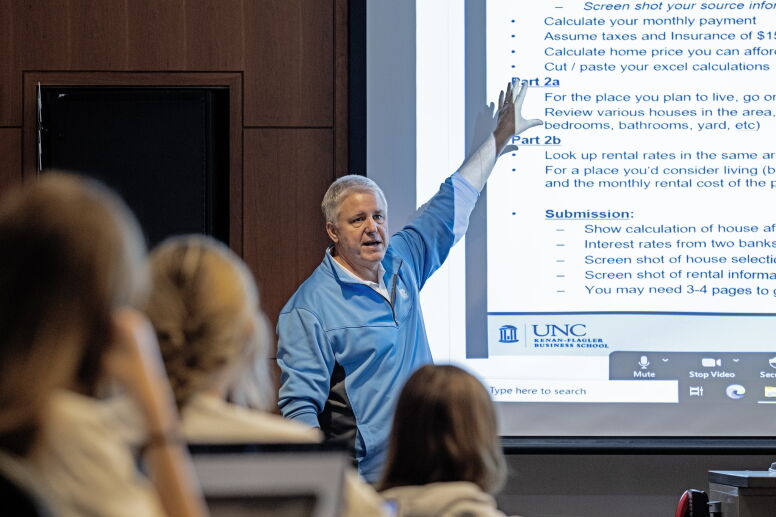

Chip Snively has taught finance courses to undergraduate business majors and MBA students since he joined UNC Kenan-Flagler Business School in 2011.

Snively, who says his move from the corporate world to academia was the best move he could have made, sees his job as helping students realize their greatest potential.

Now UNC Kenan-Flagler is sharing his expertise and passion for teaching with even more students: Snively is teaching a new personal finance class for non-business majors.

“Business is like English: every student needs to learn about it,” says Dean Mary Margaret Frank (BSBA ’92, MAC ’92, PhD ’99), who changed her UNC major from art history to business because she knew she needed a business foundation to realize her dream of starting an art gallery. “Whatever field you plan to go into, business affects your life, work and community.”

The personal finance class grew out of parents’ desire for UNC to develop students’ financial literacy.

At the same time, the University was seeking ways to raise the social mobility of certain groups, particularly first-generation college students, says Abigail Panter, senior associate dean for undergraduate education and a professor of psychology.

“There is nothing like a solid course with a syllabus and formalized education that makes sure all the pieces are there,” says Panter. “There is no match for such a course.”

Perrin Jones (BA ’94), an anesthesiologist and UNC Board of Trustees member, also strongly supported the development of a personal finance course. Having students graduate from Carolina able to manage their personal finances is a matter of providing a great return on investment.

“In my practice, people come in for interviews who have taken out loans for college and graduate school and have a significant amount of debt,” says Jones. “My thought was that it would be good for students to know how to manage their finances as early as possible, to minimize some of the debt that they will have when they graduate. That could impact whether they take out a loan or if they get a job while they were in school.

“This course breaks it all down,” he says. “What is the interest rate? What are the terms? How do you manage your money when you start saving and investing? This is all important in our society.”

Jon Gardiner/UNC-Chapel Hill

Devising a plan for personal finance

So, work began to develop a personal finance course for undergrads. University administrators turned to UNC Kenan-Flagler leaders who turned to Snively, who already was teaching a personal finance class for business students.

Snively spent six months designing the course, thinking about how he could best deliver one of the most practical courses the students would ever take. The first time around he taught three sections of 45 students each in the fall and spring semesters. By year’s end, he had taught about 270 students and the course was a resounding success.

Offerings of the course have expanded and will reach about 650 students this year and about 1,200 next year, and might incorporate options for UNC staff.

Students learn about savings, investing and budgeting. For their final project, each student devises a five-year financial plan, which requires thinking about their post-undergraduate life.

To begin, they determine where they will be working and living, the income they will be earning, additional sources of income and the type of lifestyle they expect to have. To round out the final project, the student sets five financial goals, considers budget and forecasting, and risks and concerns.

Snively takes a realistic approach to personal finance.

“You’re not going to walk out of here and be Warren Buffett,” he tells students. “But I want to move you to being intellectually curious about these things. One, because it matters to you. Whether you’re a Russian history, econ, journalism or chemistry major, all of this is relevant for you when you leave here. Actually, it’s relevant now.”

Students will make financial mistakes those first years out of college, says Snively, who is humble about his own. “I show them the mistakes I’ve made and there are some massive ones,” he says.

Students’ emails convey they are grateful for what they are learning, lessons they they expect to use forever. Parents are thrilled, too, says Panter.

Hope for growth

UNC Kenan-Flagler hopes to widen the reach of the course.

Ideally, every UNC student would take the elective and plans are to tie it to general education courses, says Panter. “It’s a gift for the University that we have an outstanding professor like Chip with decades of experience, to teach our students. This course is a special pearl.”

Snively is gratified by students’ reactions. “The course isn’t going to solve everyone’s problems out there,” he says, “but we’re elevating the dialogue.”